Starting Business in India by Foreigner

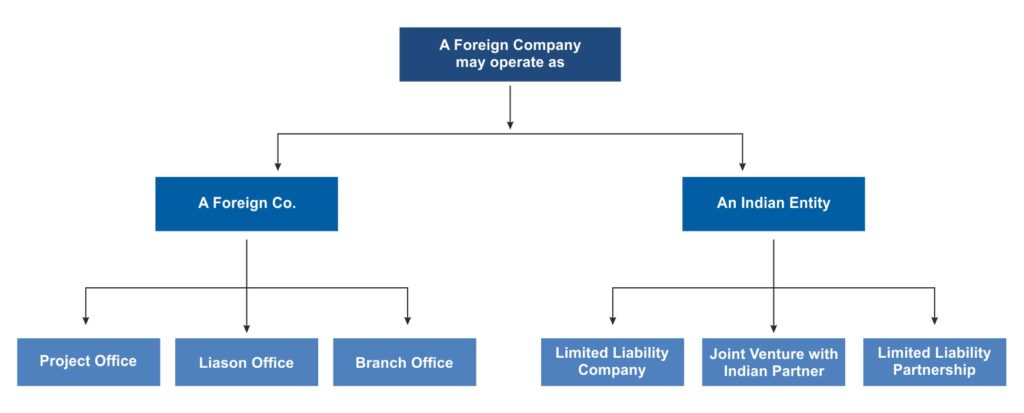

There are several ways in which a foreign company can set up business in India. A company can enter the Indian market by registering a completely Indian entity or as a foreign company. In this article, we look at a few important facets of available structures in India.

I. Liaison Office

A Liaison Office (LO), sometimes referred to as a Representative Office, is a good way to establish a new presence in India. An LO liaises, communicating between the parent company and Indian entities. While an LO can promote the parent company’s interests and build a network, it cannot make money within India; all operating costs are borne from internal funds.

Meaning

As per law, ‘Liaison Office’ means a place of business to act as a channel of communication between the Principal place of business or Head Office by whatever name called and entities in India but which does not undertake any commercial /trading/ industrial activity, directly or indirectly, and maintains itself out of inward remittances received from abroad through normal banking channel.

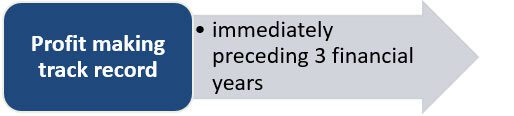

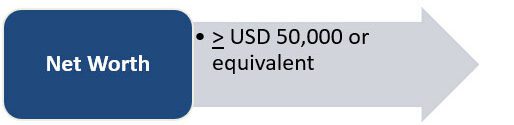

Requirements to Establish Liaison Office

Registration

Registration of an LO is approved by RBI and then by MCA. It generally takes 45 days to register an LO and requires renewal after 3 years.

Permitted activities

i) Representing in India the parent company/group companies.

ii) Promoting export import from/to India.

iii) Promoting technical/financial collaborations between parent/group companies and companies in India.

iv) Acting as a communication channel between the parent company and Indian companies

LOs are by far the cheapest option of establishing an office in India, but provide limited scope of what a business can do in the country. Foreign companies use LOs primarily to oversee networking, create visibility about a company, and to chart out future business opportunities in India.

Posting of Expatriates

Remittance outside India

Permitted Incomes

II. Branch Office

Similar to an LO, Branch Office (BO) is not an incorporated company, but an extension of a foreign company. BOs can, however, engage in commercial business as a representative of the parent company. The BO can conduct research, carry out import and export activity, provide consultancy support, provide services in information technology (IT), and provide technical support for products supplied by its parent company.

Meaning

As per law, Branch Office’ in relation to a company means- (a) any establishment described as a branch by the company, or (b) any establishment carrying on either the same or substantially the same activity as that carried on by the head office of the company, or (c) any establishment engaged in any production, processing or manufacture, but does not include any establishment specified in any order made by the Central Government.

Requirements to Establish Branch Office

Registration

Permitted activities

- Export/Import of goods

- Rendering professional or consultancy services.

- Carrying out research work, in which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying/selling agent in India.

- Rendering services in Information Technology and development of software in India.

- Rendering technical support to the products supplied by parent/group companies.

- Foreign airline/shipping company.

The RBI prohibits BOs from conducting manufacturing and processing work directly. BOs must subcontract such work to an Indian manufacturer. However, the RBI has made exception for BOs operating in Special Economic Zones (SEZs), allowing these particular BOs to engage in manufacturing themselves.

Posting of Expatriates

Remittance outside India

A branch Office in India may remit outside India the profit of the branch net of applicable Indian taxes, on production of the following documents, and establishing the net profit or surplus, as the case may be, to the satisfaction of the authorized dealer through whom the remittance is affected.

a) Certified copy of the audited balance sheet and profit and loss account for the relevant year;

b) A Chartered Accountant’s certificate certifying, –

i) The manner of arriving at the remittable profit,

ii) That the entire remittable profit has been earned by undertaking the permitted activities, and

iii) That the profit does not include any profit on revaluation of the assets of the branch.

Permitted Incomes

III. Project Office

A project office operates similarly to a branch office, the main difference being that a company establishes a project office for specific work in India. Project offices may be set up for carrying out construction or for projects co-funded by Indian and international financial institutions. .

Meaning

Project Office’ means a place of business to represent the interests of the foreign company executing a project in India but excludes a Liaison Office.

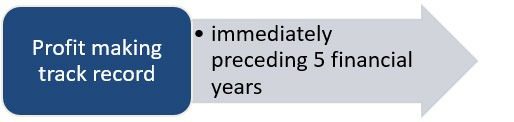

Requirements to Establish

Registration

Permitted activities

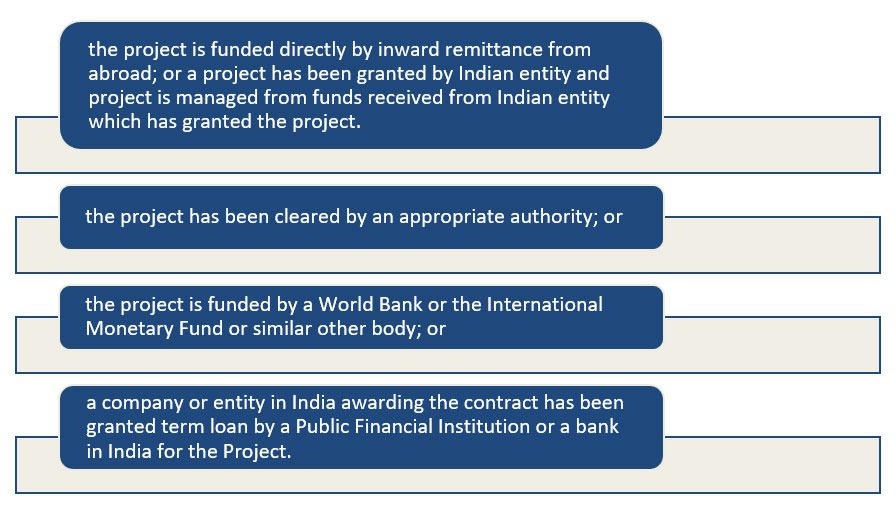

A foreign Company may be permitted to open a Project Office/s in India provided it has secured from an Indian company, a contract to execute a project in India. Project Office shall not undertake or carry on any other activity other than the activity relating and incidental to execution of the project.

Posting of Expatriates

Remittance outside India

A Project Office in India may be permitted for the intermittent remittances pending winding up / completion of the project provided they satisfy the bonafides of the transaction, subject to the following:

a. The PO submits an Auditors’ / Chartered Accountants’ Certificate to the effect that sufficient provisions have been made to meet the liabilities in India including Income Tax, etc.

b. An undertaking from the PO that the remittance will not, in any way, affect the completion of the project in India and that any shortfall of funds for meeting any liability in India will be met by inward remittance from abroad.

Permitted Incomes

Operating as an Indian Company

IV. Limited Liability Company (Wholly owned subsidiary)

Meaning

Registration

Permitted activities

- Lottery Business including Government/private lottery, online lotteries, etc.

- Gambling and Betting including casinos etc.

- Chit fund

- Nidhi company

- Trading in Transferable Development Rights (TDRs)

- Real Estate Business or Construction of Farm Houses ‘Real estate business’ shall not include development of townships, construction of residential /commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations 2014.

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

- Activities/sectors not open to private sector investment e.g. Atomic Energy

Posting of Expatriates

Remittance outside India

Remittance is allowed by way of:

1. Dividends

2. Royalties

3. Fees towards technical knowhow

4. Remittances under Supply Contracts (subject to limitation of matters of ‘Related Party transactions’)

Permitted Incomes

Operating as an Indian Company

V. Limited Liability Partnership

A limited liability partnership firm (LLP) is a cross between partnership firms and a limited company. An LLP is a separate legal entity than its members, which means that the liability of members is limited to their agreed contributions. Only in sectors where the RBI permits 100 percent foreign direct investment (FDI) can a foreign company establish an LLP. Under Prime Minister Modi, the Indian government has eased FDI restrictions and the list of sectors under 100 percent FDI is growing.

LLPs can buy and own property, produce revenue, and remit earnings outside of India. LLPs are taxed at 30 percent, and an additional surcharge and cess.

In comparison to a Limited Company, an LLP requires less paperwork and minimal record keeping. An LLP also has a reputational advantage over a Partnership Firm because of the additional registration involved. An LLP must register with the Ministry of Corporate Affairs, lending credible proof of the company’s existence.

VI. Joint Venture

A joint venture is a partnership between two or more companies or individuals who agree to pool capital or goods into a uniform project. Joint ventures in India have been most popular for sectors that do not have 100 percent FDI.

Joint ventures offer relatively low risk to foreign companies, provided that these companies conduct due diligence on their Indian partners. A joint venture allows foreign companies to utilize the existing networks of their Indian partners, and once taxed, such companies can remit their Indian profits outside the country.

JVs are subject to corporate tax @ 30% plus surcharge and cess.

Making the right choice

Choosing whether to set up an office, firm, or company in India has to correspond to a company’s size, ambitions, and desired trajectory in the country. An LO may work best for a smaller company exploring prospects in India. Alternately, incorporating a limited company would be the logical decision of a company looking to aggressively expand within Asian emerging markets.

- In making a decision for your business, do consider consulting Aplite advisors on the following:

- A review of the latest laws and regulations;

- Due diligence for would-be partners and service providers;

- Operational issues – such as connectivity, labor laws, and state-based regulations –when planning the physical location of your Indian presence; and

- Exit strategy planning for limited control establishments.

Other Related Services:

Nominee Director Services

Features:

- May be either an individual or a corporation based on specific jurisdiction requirements.

- Has the same legal obligations and responsibilities as any other director, but will not be involved in any day to day operations of the company.

- Serves as a non-executive director on behalf of another person or firm on the board of directors of a company, such as an entity, investor, or lender.

- A nominee director can also act as a secondary signatory on a company bank account.

- Not retire by rotation

Appointment of Nominee Director:

Step-1: Ensure that articles of company contain authorisation to appointment of nominee director, if not then alter the same.Step-2: Obtain DIN by filing form DIR-3

Step-3: consent in writing in form DIR-2 from proposed director

Step-4: Intimation by proposed director in Form DIR-8 u/s 164(2)

Step-5: Convey a Board meeting for appointment by giving notice(not less than 7 days before meeting) to directors

Step-6: File form DIR-12 as return of appointment with ROC within 30 days from passing BR

Step-7: After appointment director has to furnish form MBP-1(Disclosure of Interest)

Documents Required:

- Copy of BR passed

- Id proof

- Address proof

- Details of Nominee director along with DIN